MESSAGE FROM THE CEO/PRINCIPAL OFFICER

Spring has sprung and as the flowers blossom, I hope that this new season will put a proverbial ‘spring’ to your step even amid all that is happening in the world. We all have fought a good fight and endured through it all. The past couple of months we witnessed a plunge in economic turmoil as we watched from our screens, unrest and looting in KwaZulu-Natal and Gauteng. Yet through it all we soldiered on, we continue to do so as we anticipate tomorrow and wonder if the new normal is on the horizon.

One aspect of your life that should have become even more important during these uncertain times is to ensure that you have made provision for your retirement by constantly monitoring your net replacement ratio. If you belong to the Provident Fund, ensure that you are contributing the highest contribution rate which is 9,25% in order for your employer to contribute the maximum rate of 18%. It is also equally important that your beneficiaries are nominated and that we have your updated contact details.

In the last couple of weeks, the Fund has been receiving queries from members regarding the facilitators agreement. Attached to this newsletter is the Fund Insight giving an overview of what the agreement is all about and the opinion of the Fund regarding the agreement. I would like to urge all members to take time and read the agreement carefully and probe it in writing with their respective trade unions.

INVESTMENT PERFORMANCE

The second quarter of 2021 was a positive quarter for Developed Market equities as Covid-19 restrictions eased. The widening gap between vaccine roll-out in Developed Markets and Emerging Markets however took its toll on the latter’s equity performance. China’s equity performance dipped due to profit-taking and open market operations by People’s Bank of China. Commodity prices have begun to drop on the back of China’s strong rhetoric against commodity price manipulations. China’s slowdown is a headwind for commodity prices and despite global fiscal spending supporting commodities, we can expect further commodity headwinds into the end of the year.

The positive returns over the last 15 months are good news for Provident Fund members whose benefits are directly linked to investment returns. It is also good news for pensioners where future pension increases are dependent on past investment returns. Members in the Retirement and Superannuation Funds are not directly affected by investment returns as their benefits are formula driven and set out in the Regulations. They can however also be pleased as the positive returns will aid in returning these two funds to a financially sound position.

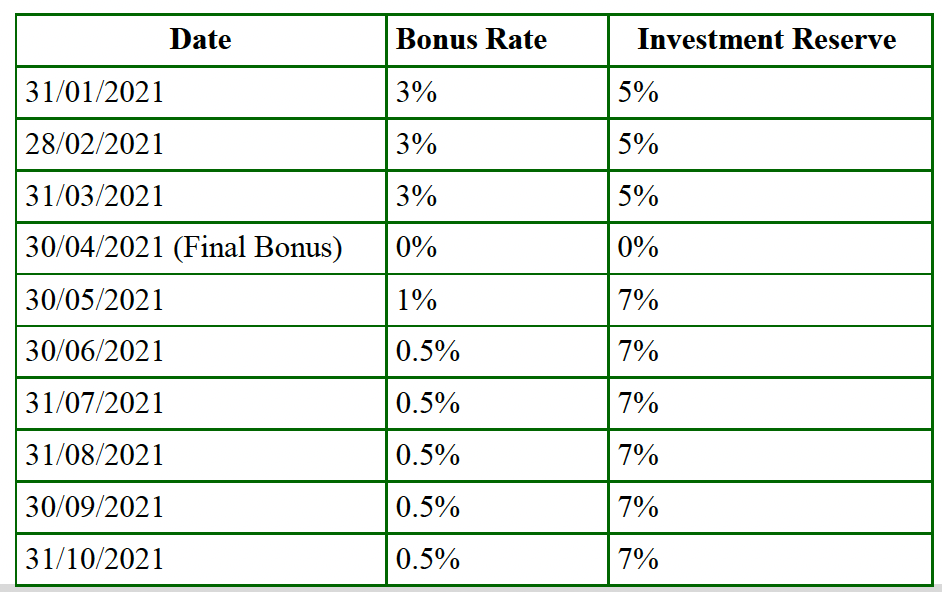

Here is a table showing the monthly investment declarations of the NJMPF Provident Fund:

The market recovery also highlights the generally accepted wisdom that remaining invested during times of uncertainty (such as what was experienced in March 2020) is likely to result in members being much better off over the longer term than moving out of the market and trying to decide on the best time to go back in. Members who opted to preserve their retirement savings during 2020, even if their employment came to an end with their local authority, would have benefited most from this.

THINK ABOUT YOUR RETIREMENT NOW

As your Fund, we strive to ensure that you are looked after from the date that you join the Fund to retirement and beyond. It is never too late to start thinking about retirement. With our continuous communication we want to provide you with the relevant and continuous guidelines in thinking and planning for your retirement to ensure that you are always one step ahead of your peers. As an NJMPF member we want you to be in a position to retire comfortably and financially free. Here are a few questions we would like you to constantly ask your self when it comes to your retirement:

1. Are your contributing the highest percentage rate?

2. Will you have enough money to sustain you throughout your retirement life?

3. What age will you retire?

4. What is your expected source of income in retirement?

5. How will you pay for your medial aid and health care?

EXITING THE FUND?

Here is what you need to know:

I am thinking about retiring, what are my options?

A Client Services administrator will have to perform Retirement Benefit Counselling and explain the Fund’s living Annuity options to you which include: The In-Fund low-cost living annuity, becoming a paid-up member or being a deferred retiree.

These options which are available to all members form part of ensuring that your financial futures are prioritised, because we all know that having enough money to live through retirement is essential.

Would you like to defer/preserve your benefit?

For members who are not sure as to what they want to do with their benefits, this option is a smart option especially to members who exit the municipality before the age of 55, this option also helps you limit adverse tax penalties.

There is no restriction on when you can withdraw your deferred/preserved benefit. Once you are ready to withdraw your benefit you can contact the Fund and start with your claim process.

You can also become a NJMPF paid-up member.

Don’t know what to do with your lumpsum benefit when you exit the municipality?

Well, worry no more!

Members younger than 50 do not have to withdraw their benefit. Yes, you heard right.

You can become a paid-up member, you can preserve your resignation, dismissal, or retrenchment benefit with NJMPF.

By leaving your money invested with the Fund, you will continue to earn returns allowing your hard-earned savings to continue growing until you are ready for retirement. This will also help you save a whole lot when it comes to tax.

For more information on becoming a paid-up member or any of the great retirement options available from NJMPF, contact our Client Services department on 08610 NJMPF (65673) or email info@njmpf.co.za.