Net Replacement Ratio (NRR)

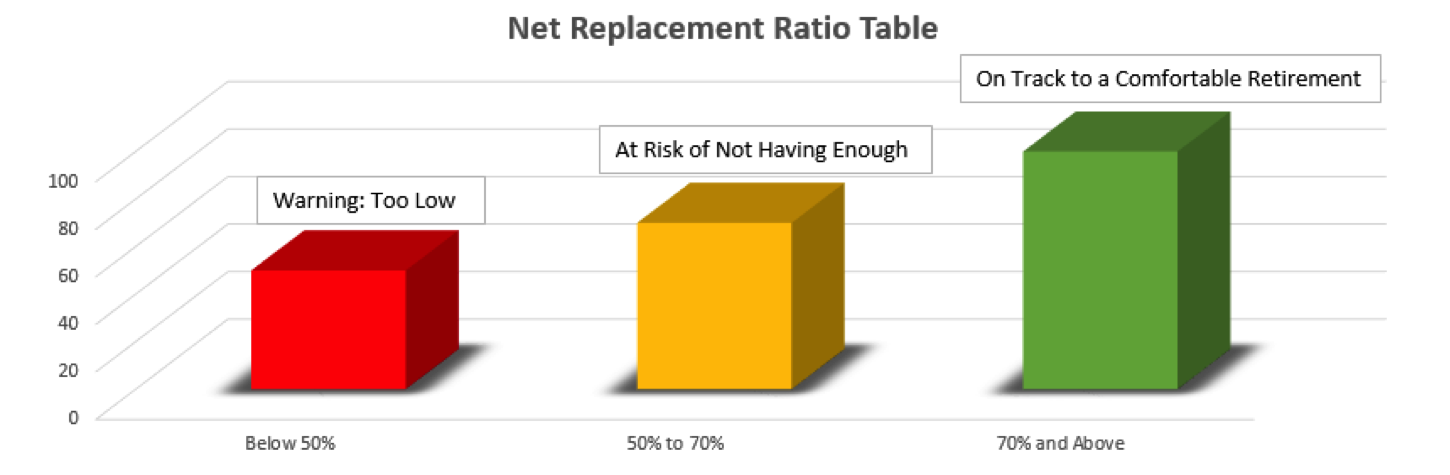

NRR is the member’s projected pension at retirement, expressed as a percentage of his or her projected salary at retirement. The NRR is a useful tool which can guide members in their retirement planning.

The greatest risk for a member of a Pension or Provident Fund is that their retirement savings are insufficient to meet their needs. This could mean that the pensioner does not have enough to pay their monthly expenses or it could mean there is insufficient income to maintain their lifestyle after retirement.

The NRR is one of the useful tools that we can use to measure the adequacy of current retirement savings by looking at the member’s projected pension at retirement expressed as a percentage of his or her projected salary at retirement.

Below are various factors used to determine the value of your pension benefit.

- The type of Fund you are invested in is a key factor:-

- A Defined Benefit Scheme is a formula based benefit using your final average salary over the last year and years of service.

- A Defined Contribution Scheme is an accumulation of contributions and growth into a retirement savings pool.

- For Defined Contribution funds, the following factors determine the end benefit:-

- Level of contributions to the fund,

- Returns earned on those contributions, and

- The period of the investment. The longer a member contributes, the larger the savings pool will be.

Most members will not receive a pension that matches their salary or standard of living on retirement

Importantly though; a member should know what percentage of final income it will replace.

Experts say that in South Africa we have a very low savings rate, which means that most members do not save enough or contribute enough to their Retirement Funds. Coupled with this, many members cash out their retirement savings when they switch jobs, and do not preserve the savings they have accumulated. This has a significant impact on the NRR as many years’ worth of savings are lost and will reflect as such with the NRR scoring. Furthermore, the non-preservation of retirement benefits when an employee changes employment, is one of the biggest contributing factors to the low NRR’s in South Africa.

Members do not necessarily need 100% of their salary as a pension when they retire, and are often able to retire comfortably with a NRR of 70%. This is because after retirement living expenses are usually lower and debts are usually paid off.

Should you aim to receive 75% of your final salary as a pension or do you only need 60% or should you aim for your full salary as pension? Your NRR depends largely on the lifestyle you want to maintain once retired. It is clear that it will not be appropriate to apply the same NRR for every member. An acceptable NRR therefore depends on the member’s circumstances and expected lifestyle after retirement.

Various authors agree on a number of factors which assist in attaining a positive Net Replacement Ratio:-

- start saving early,

- save at the correct contribution levels,

- ensure the investment portfolio is appropriate, and

- Do not cash in your retirement benefits when changing jobs (preserve the benefit)

This gives the member the best chance of having a comfortable and care free retirement.

All fund members need to analyse their projected pension at retirement regularly. The perception, especially among younger employees, is that one can postpone saving towards retirement until a later age but this is not correct.

Members are always encouraged to consult a suitably Certified Financial Planner, to ensure that the appropriate choice is made when considering your NRR and planning for retirement.