08610 NJMPF (65673)

info@njmpf.co.za

Members

Learn how to log into your account to get an up-to-date report on

How to Claim

Download Claim Documents

Submit Claim Documents

What we offer

In-House Living

Annuity

Pension Back

Housing Loan

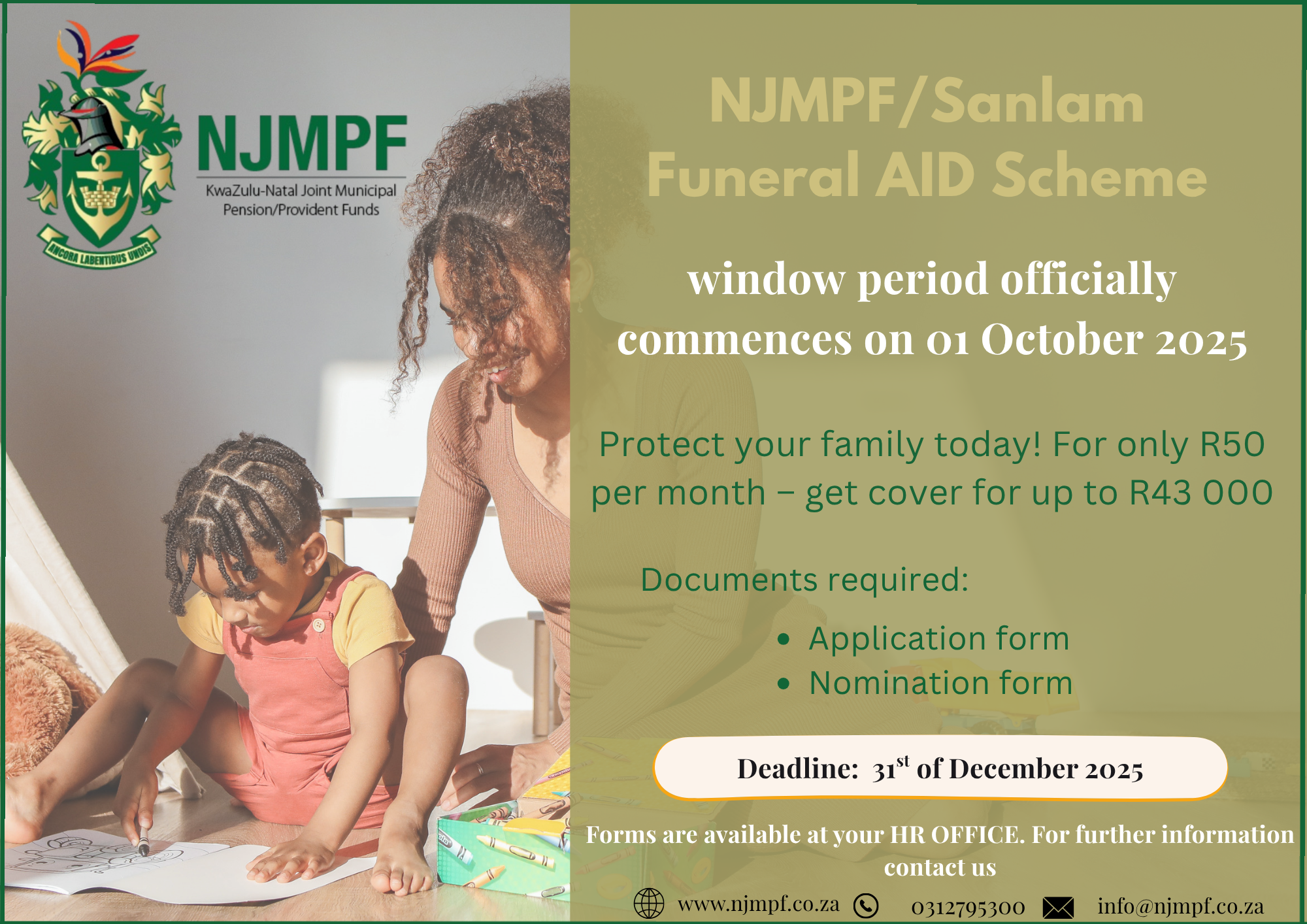

Funeral Aid

Schemes

Wills

.

Financial

Literacy

TOTAL ASSETS

Billions of Rands

CURRENT MEMBERS

PENSIONERS

Latest NJMPF News & Articles

Delays in Processing Member Exit Payments

SARS has extended the turnaround time for issuing tax directives to 21 working days. Download PDF

IMPORTANT NOTICE

We urgently request all pensioners and members who bank with Ithala Bank to provide the Fund with new banking details. Download PDF.

Two-Pot Update

An update to members that submitted claims on their Two-Pot Savings Component. Download PDF.